The Hidden Dangers of Abandoning CPI

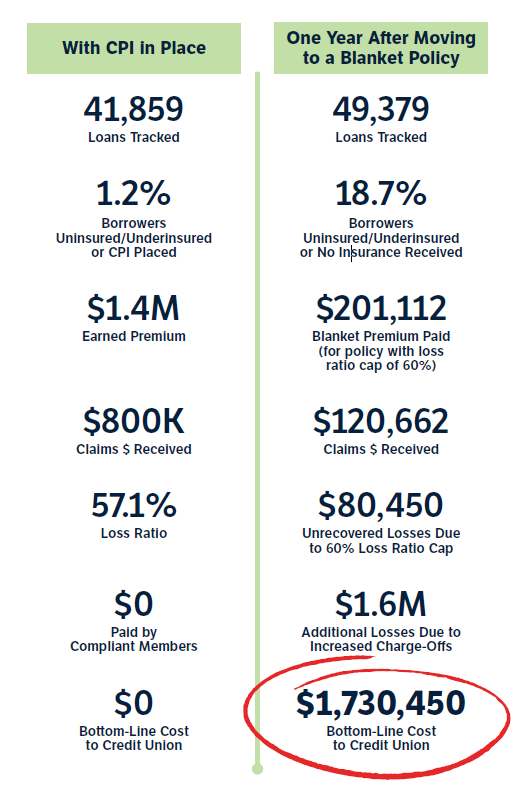

Over the past 50+ years we have seen how unintended consequences often surprise lenders who choose to switch their portfolio protection solution from CPI to a blanket policy. For many credit unions, it seems like a good option — until later down the road when both their number of uninsured borrowers AND their premiums keep rising.

Without the monitoring of the loan portfolio that comes with CPI, it has been shown time and again that the number of uninsured borrowers will increase and the credit union’s losses will grow larger.

To show how this plays out in a real-world example, one of our current clients* recently worked with us to run a test on their portfolio after they decided to move to blanket coverage, by continuing to track their borrowers' insurance status (to ensure their privacy, we'll call them "Best Lending Institution").

*Actual percentages and dollar amounts for existing credit union with approximately $2B in assets.

These results are for year one. If Best Lending stays with a blanket policy, they can expect to see the number of uninsured borrowers go up, monetary losses rise, and premiums paid for their blanket policy increase.

The evidence is clear — a blanket policy:

- Increases charge-offs

- Increases the number of uninsured borrowers

- Increases the number of policies missing the lienholder

- Increases the number of policies where borrowers are out of compliance with their loan agreement because they have raised their deductibles or reduced coverages

- Removes any enforcement mechanism to encourage uninsured borrowers to obtain coverage

- Leaves the credit union with significant blind spots regarding where the risk is in their portfolio

- Removes borrower participation coverage and requires the credit union to repossess the collateral

- Will continue to increase in cost as the credit union's loan portfolio grows, regardless of loss ratio

In contrast, a well-run, well-managed CPI program has the following advantages:

- You can identify where your risk is and keep it from rising

- A more fair and equitable program for those members who are compliant and your membership as a whole

- Incentive for uninsured borrowers to become insured

- Positive impact on lender’s bottom line, and cost savings can be redistributed to members

- No up-front fees — costs the credit union little or nothing

- Extra lender coverage options, such as towing coverage, mechanics lien coverage, waiver of actual cash value, and skip coverage available

- Freedom from yearly increases in blanket insurance premiums

- Borrowers are able to file claims under Waiver of Repo coverage, offering additional protection to your members

Want to learn more about safeguarding your lending portfolio? Contact us for information on how our CPI program can benefit your credit union.

.png?width=496&height=624&name=Screenshot%20(14).png)