Protecting your auto loan portfolio doesn’t need to cost your credit union, bank, or finance company as much money, time, and resources as it does today. With seamless implementation and a multitude of unique advantages in our service model, State National saves lenders money. Just how much? Let’s find out!

1. How many auto loans do you have in your portfolio and how much time per week does your staff spend on managing collateral protection in your current portfolio?

Our program is built to free up your staff’s capacity and provide you with FTE savings.

Our exclusive lender platform, InsurTrak, has every tool you need, including:

- Real-time data on borrower insurance status, notifications sent, account history, insurance documentation, and all borrower interactions

- Instant, on-demand access to all recorded borrower phone calls.

- Fast, automated payment change and refund information

- On-demand management reports and customized, transparent reporting of all aspects of your program

Created in-house and customized for CPI programs specifically, InsurTrak is the industry powerhouse in tracking, claims filing, reporting, and program management, all in one user-friendly, easy-to-use platform.

“Efficient? I’d estimate State National’s system saved us 6 figures and 1 FTE!”~ Steve McIntire, VP of Administration and General Counsel, SELCO Community Credit Union

2. What is your 12-month claim benefit?

State National returns, on average, 20% more in claim dollars than other providers.

Because we are the carrier, underwriter, and claims payer, there is no middleman and almost no paperwork required. Many claims are processed in 10 seconds with AI and those that need further review are paid within an average of 7 days of their submission date. That’s 7 days — start to finish.

Additionally, filing a claims payment has never been easier for your team. Our claims form comes pre-populated with data from InsurTrak. You don’t even have to decide which claim type you want to file — we automatically process each claim for ALL available coverages, regularly returning more dollars to you.

Did I mention we have broader coverages that provide more value to the financial institution? Not only that, but we offer a borrower-centric coverage that allows your borrower to file a claim even if they are uninsured!

“If we had to do it all ourselves, we'd have to have a couple of personnel on staff full time making sure our members have insurance.”~ Bob Steensma, CEO, Five Star Credit Union

3. If you have a CPI provider, what is your current CPI penetration?

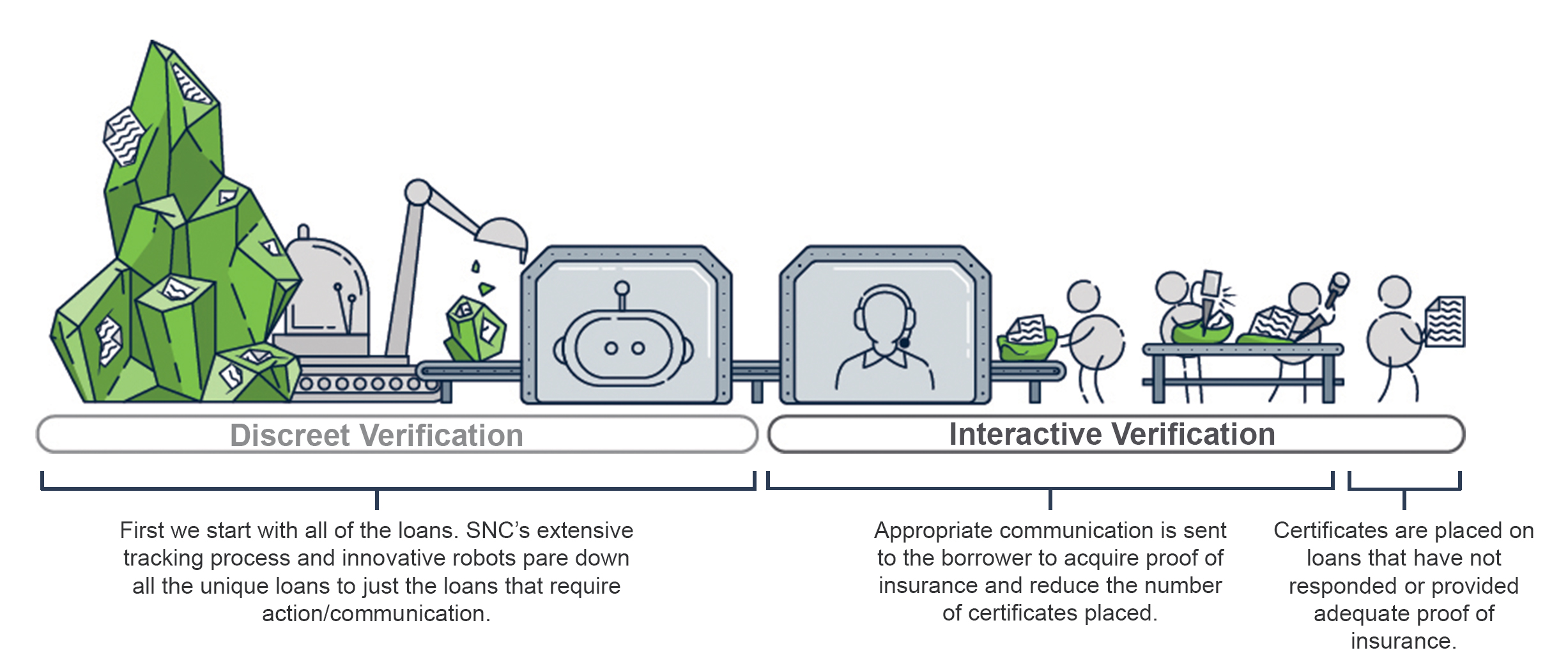

We reduce CPI penetration by 20-30% because of our proprietary AI tracking software, proactive verification methods, and our email and text programs.

Our Web-Based Robotic Automated Processing (WRAP) software automatically extracts insurance information from insurer websites and updates it in InsurTrak — without any human effort or intervention. WRAP uses AI and machine learning to proactively search for new policy information from seven different carriers, including the country’s top five auto insurers, before ever notifying a borrower.

Only if we can’t verify insurance through WRAP or our other proactive and behind-the-scenes verification methods do we reach out to the borrower via multiple channels, including email and text. Borrowers can easily respond through the channel they prefer — email, phone, or our borrower-facing MyLoanInsurance.com portal. They can even send an image of their insurance information by text!

All this combines to create a more seamless, frictionless experience that results in lower penetration rates and greater client and borrower satisfaction.

4. What core processor do you use?

InsurTrak is engineered to work seamlessly with all major core processors.

Because innovation is our mindset, we have multiple automation options available to accommodate your systems and processes. When designing InsurTrak, we kept software compatibility a top priority. This means seamless real-time premium adds, refunds (including partial refunds), and payment syncing.

With minimal steps to set up, you can link Symitar Episys, Temenos, and AKUVO directly to InsurTrak. For those who use Symitar Episys, State National has set up two-click direct connectivity, allowing all InsurTrak data to be accessed through your Episys system. Temenos and AKUVO users can easily connect to InsurTrak within their frameworks using the State National connector.

Switch Without a Glitch

Once you decide to partner with State National, our dedicated Program Implementation Team is there to guide you all along the way and answer any questions you may have during any step as you onboard.

“It was the best implementation I have done with any company. It was flawless.”~ Joy Dominguez-Mota, Department Manager, Nationwide Acceptance

Want to determine the actual savings your financial institution can achieve with these advantages? Let us know your answers to these questions and see how you can take advantage of these and other exclusive benefits.

Sign up for an in-depth, customized consultation and program review today to see how much time and money we can save you!