Tracking Alone Is Not Enough

We’ve all seen the headlines: Inflation is up. Purchasing power is down. Both new and used car values are inflated. Borrowers are taking out larger loan amounts. Any way you look at it, many consumers are feeling strapped — and when people are struggling financially, they look for any way they can to save cash. Unfortunately, a common “solution” is to let their auto insurance lapse, or raise their deductible.

That’s one of the reasons why many smart lenders in the finance company space maintain an insurance tracking program to ensure their borrowers are maintaining adequate private coverage. And that’s a good move, because uninsured or underinsured borrowers create a big risk of heightened charge-offs in a lender’s portfolio.

That’s one of the reasons why many smart lenders in the finance company space maintain an insurance tracking program to ensure their borrowers are maintaining adequate private coverage. And that’s a good move, because uninsured or underinsured borrowers create a big risk of heightened charge-offs in a lender’s portfolio.

Bad news: That’s not enough to keep you protected

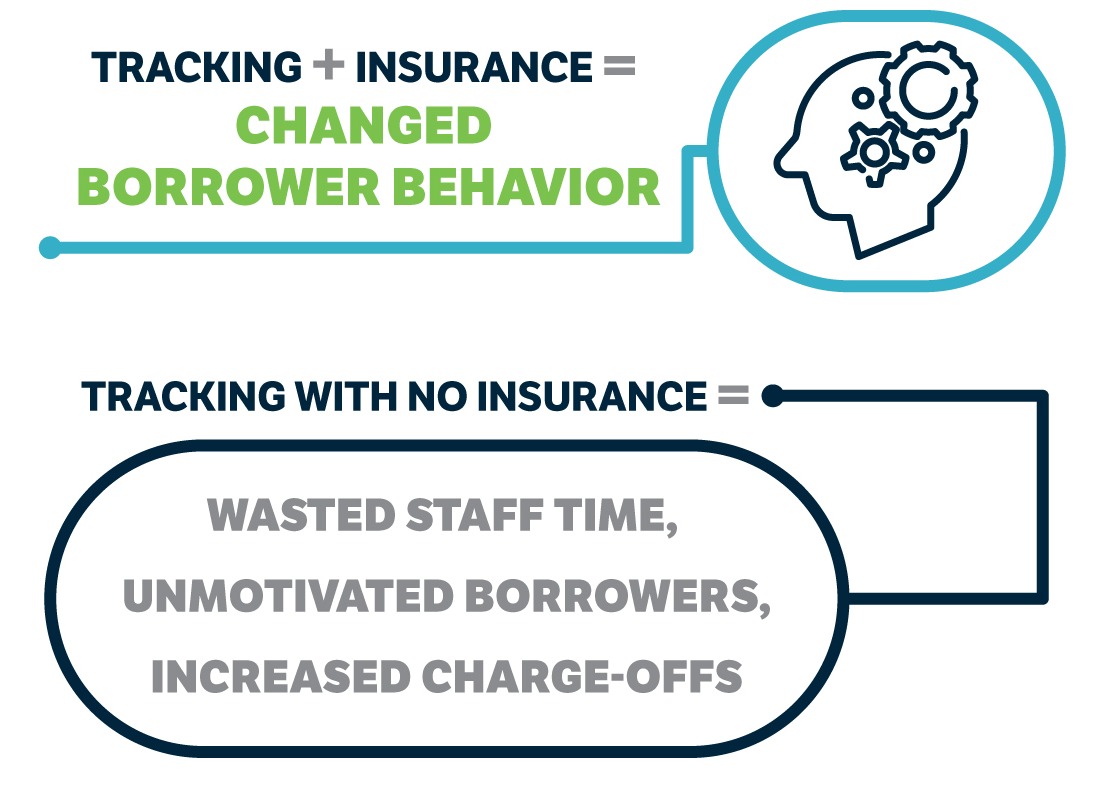

Insurance tracking alone is not enough. Research has shown that merely tracking who’s covered and who’s not does not effectively or reliably change borrower behavior. Even with repeated reminders to correct the deficiency, without an enforcement mechanism a significant percentage of borrowers, particularly non-prime or subprime borrowers, simply won’t maintain the coverage they committed to in their loan agreement. Unless there is some consequence for noncompliance, many are unlikely to take the initiative to purchase a policy just because of letters or phone calls from their lender.

![]()

“But tracking is so cheap!”

Lenders will sometimes tell me that a tracking-only program is such a negligible cost that it’s not a big concern. What they don’t realize, though, is that any amount they spend on it is largely money they’re flushing down the drain. Because passive tracking only, without a creditor-placed product, doesn’t change borrower behavior, it also doesn’t change your institution’s risk profile — your risk is still there! And isn’t lowering your risk the purpose for tracking insurance in the first place?

On the other hand, when you combine a technologically sophisticated tracking system with a high-quality creditor-placed insurance product, you’re getting the most bang for your buck, in two important ways:

- First, you’ll have an insurance product in case there’s a repo damaged vehicle — a product that is affordable, collectable, and has value for the borrower too.

- Second, many of your uninsured borrowers, when faced with certificate placement, will actually respond — they go out and get good insurance!

Relief, not regret

When a borrower who was incentivized to go out and purchase their own coverage has an accident, it’s their insurance company they’re going to call — not you. Meaning this borrower’s accident isn’t going to turn into your problem, your charge-off, or a ding on your balance sheet.

Doesn’t that sound better than the frustration of realizing that you KNEW a borrower was uninsured and even told them about it, but they didn’t take action — and now your portfolio is taking a hit because they drove uninsured anyway and got in an accident? Sure, there are alternative standalone programs that offer protection on some repossessions, but that’s only for filing lienholder claims on repos that actually have private insurance. The bulk of your losses are with the accounts that have no insurance in the first place.

Doesn’t that sound better than the frustration of realizing that you KNEW a borrower was uninsured and even told them about it, but they didn’t take action — and now your portfolio is taking a hit because they drove uninsured anyway and got in an accident? Sure, there are alternative standalone programs that offer protection on some repossessions, but that’s only for filing lienholder claims on repos that actually have private insurance. The bulk of your losses are with the accounts that have no insurance in the first place.

It’s more important than ever to keep ALL your risk mitigation bases covered

As the risk of uninsured, underinsured, and cash-strapped borrowers increases, it’s vital to provide them with the kind of incentive that will keep your collateral covered. The more financially stressed they are, the more unlikely they are to obtain coverage just because they received a letter in the mail or a phone call from your collections staff (if there’s even anyone with time to make those calls, with the challenges of finding, keeping, and training staff in today’s environment).

As the risk of uninsured, underinsured, and cash-strapped borrowers increases, it’s vital to provide them with the kind of incentive that will keep your collateral covered. The more financially stressed they are, the more unlikely they are to obtain coverage just because they received a letter in the mail or a phone call from your collections staff (if there’s even anyone with time to make those calls, with the challenges of finding, keeping, and training staff in today’s environment).

Protecting your borrowers and your business

Uninsured borrowers and charge-offs can be a costly reality for any auto lender. Combining accurate, technology-driven tracking WITH a high-quality insurance product is a proven way to mitigate the risk of charge-offs hitting your balance sheet. A comprehensive portfolio protection solution will not only be affordable to your borrowers while providing your company with robust protection — it is the only strategy that will actually change the behavior of borrowers when it comes to purchasing and keeping the coverage they need to protect both of you.