The Dual Advantage of Collateral Protection Insurance: A Closer Look at Borrower Benefits

Collateral protection insurance is most commonly thought of as a protection for lenders. And that is certainly correct — a well-run CPI program is an undeniably powerful risk mitigation tool that helps lenders safeguard their auto loan portfolios from loss. It's one of the best ways credit unions, banks, and other financial institutions can reduce financial risk associated with lending.

The benefits don't stop there, though! Even though conventional wisdom may suggest CPI solely protects the lender's financial interests, often overlooked is the fact that it can have some significant benefits for borrowers, too.

Flipping the Script: CPI as a Borrower Protection

First and most important — CPI promotes behavior change by incentivizing borrowers to purchase and maintain the correct insurance

- High-tech insurance tracking using AI automation continuously monitors the insurance status of all of a financial institution's loans, in real time.

- Loans with no insurance or impaired insurance are immediately flagged, and communications are started to encourage the borrower to remedy the issue.

- Borrowers receive a series of notifications via mail, email, and text message reminding them to obtain their own private insurance. These notifications clearly explain how maintaining insurance is one of the terms of their loan, and exactly what they need to do to get back into compliance.

- The vast majority of borrowers provide the needed insurance information prior to any addition of CPI. Most of those remaining are then prompted to do so by the certificate placement, after which they receive a refund for any unearned CPI premium.

- This is the best-case scenario for keeping your borrowers protected with both liability insurance and full coverage for their auto.

- If, despite multiple notifications, a borrower neglects to purchase their own insurance (or maintains a policy that is out of compliance with lender requirements, such as a too-high deductible) a CPI certificate is placed on their loan.

- The insurance payments are added to the borrower's loan payments.

- Borrowers don't generally love the higher payment, and they may complain — but most don't realize what they're risking without it.

- If the car is damaged, and especially if it's totaled, the borrower is able to take advantage of the CPI to repair the car, which means they can still use their car to get to work and continue to make payments on the loan.

- The borrower still does not have liability insurance (which is why private insurance is best), but now at least their own vehicle has some protection.

- Borrowers in this scenario are less likely to default on their loan, helping to protect their credit score and credit history for the long run.

- Even in the event of a repossession, while the borrower still gets a 'ding' in their credit, that ding will be less severe if the collateral was covered by CPI. A repossession with a $3,000 charge-off is ultimately much less damaging to the borrower than one with a $30,000 charge-off.

A blanket policy doesn't provide this borrower protection

- Some lenders choose a blanket or VSI policy to cover their loan portfolio, thinking it is less hassle or will mitigate borrower complaints.

- Unfortunately, among other downsides to blanket coverage, it provides NO protection for the borrower. In the case of an accident, a borrower who doesn't have private insurance of their own is completely out of luck.

- This type of insurance protects only the lender, with no mechanism to help the borrower in case of a loss.

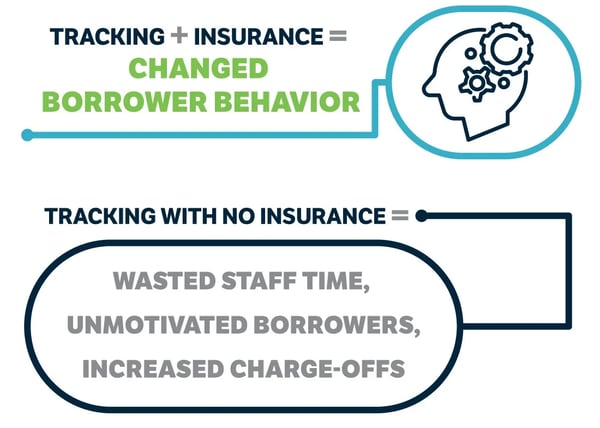

- Ironically, with a blanket policy with no insurance tracking, evidence shows that the number of uninsured borrowers in a lender's portfolio will rise, often dramatically, leaving the lender even more at risk as time goes on.

- With today's skyrocketing insurance premiums, some borrowers simply cannot purchase a policy that fits within their budget. This is especially true in the non-prime and subprime space.

- While CPI is not as comprehensive as a privately purchased policy, the borrower can still ensure their collateral is protected and allow them to secure a loan, making it a cost-effective solution for some financially challenged borrowers.

The Uninsured Borrower’s Conundrum

Suppose a borrower without insurance is involved in a collision. They are then faced with a troubling cascade of options, none of which lead to a favorable outcome. The choice is stark — bear the significant financial burden of repairs out of pocket, continue making loan payments for an inoperative vehicle, or default on the loan. All of these scenarios can create a financial disaster in a person's life.

So, although a borrower who has a CPI policy placed on their loan is most likely not happy about it in the moment, they’ll be a lot UNhappier in the event of adverse circumstances that damage their vehicle while it is uninsured or underinsured. This is especially the case for financially vulnerable borrowers who are most in need of protection.

"You could never say the borrower comes out ahead of where they would have been if they had purchased their own insurance. But you can certainly say they come out ahead of where they would have been if they had no insurance at all." ~ Loren Shelton, Vice President of Insurance Solutions

When carried out with due diligence and a genuine focus on the borrower's interests, CPI transforms from a mere regulatory formality into a robust safety net. It ensures that not only the lender's assets remain safeguarded but also that the borrower's path toward financial responsibility is paved with adequate protection.

CPI Programs: The Difference Is in the Details

The key to making sure a CPI program is protecting both borrowers and lenders comes down to the provider and the way the program is run:

- Is the technology cutting-edge, with advanced automation?

- Are insurance updates made in real time or is there a lag between receipt of insurance documentation and when it is actually entered into the tracking system?

- Are payment changes calculated automatically and precisely, swiftly returning any unearned premium when proper insurance is obtained?

- Is the provider obsessive about compliance?

- Are programs continually monitored to be sure they are providing the best value to the lender and the institution's borrowers?

Click here to learn more about how to protect both your borrowers AND your bottom line