When evaluating a Collateral Protection Insurance (CPI) program, it's important for lenders to look beyond the surface. Understanding both the hard and soft costs, as well as the potential returns, is crucial for maintaining a healthy and successful program. Here's how you can ensure you're getting true value.

The Real Returns: Beyond Incentives

One of the key factors often overlooked is not just potential program incentives, but how much in claims dollars will actually be returned to you each year and over the life of your program. Efficient claims processing, speedy payouts, ease of use, and avoiding delays — these all add up, especially over time. Comparing the total value of competing programs over 1, 3, 5, or more years can reveal substantial differences.

Payments — More Money, Delivered Faster

- Higher Payouts: We consistently pay 20% more than our competitors.

- Reduced Charge-offs: Our clients see a 30% reduction in charge-offs on average.

- Quick Turnaround: 90% of all claims are processed within 7 business days —starting with submission, not waiting until all paperwork is received.

- InstaClaim Advantage: Our exclusive AI-based InstaClaim technology automates most no-damage claims, paying out in 10 seconds or less — a capability unique to State National.

- Comprehensive Coverage: We have you covered — we pay retail vs. split book, provide coverage even if the borrower is found, and pay both physical damage and premium deficiency claims on repossessions.

- No Claim Settlement Limit: On towing & storage.

- Financial Impact: How does an extra $20-40K returned in claims dollars each year sound?

- CARS Program: Our Claims Advocacy & Recovery Service further cuts down charge-offs, boosts recoveries, and protects your whole portfolio whether your borrower has insurance or not.

Claims Process — No Games Claims

- Simplified Filing: File one claim for all coverages instead of juggling multiple submissions.

- Automatic Claim Processing: No need to pick and choose what to file — we process all applicable types automatically for you.

- Minimal Paperwork: Only skip or total loss claims require paperwork.

- Efficient Management: All managed within InsurTrak, with online claim forms pre-populated with loan file information.

- Proactive Payouts: Unlike the industry stereotype of delaying payouts, we want you to get the claims dollars you are entitled to, quickly. Why? We’re interested in fostering strong, mutually beneficial long-term partnerships.

- Skip Claims Flexibility: Submit a skip claim as soon as you suspect a loss, with no minimum waiting or pre-locate period (certain exceptions for MAP programs).

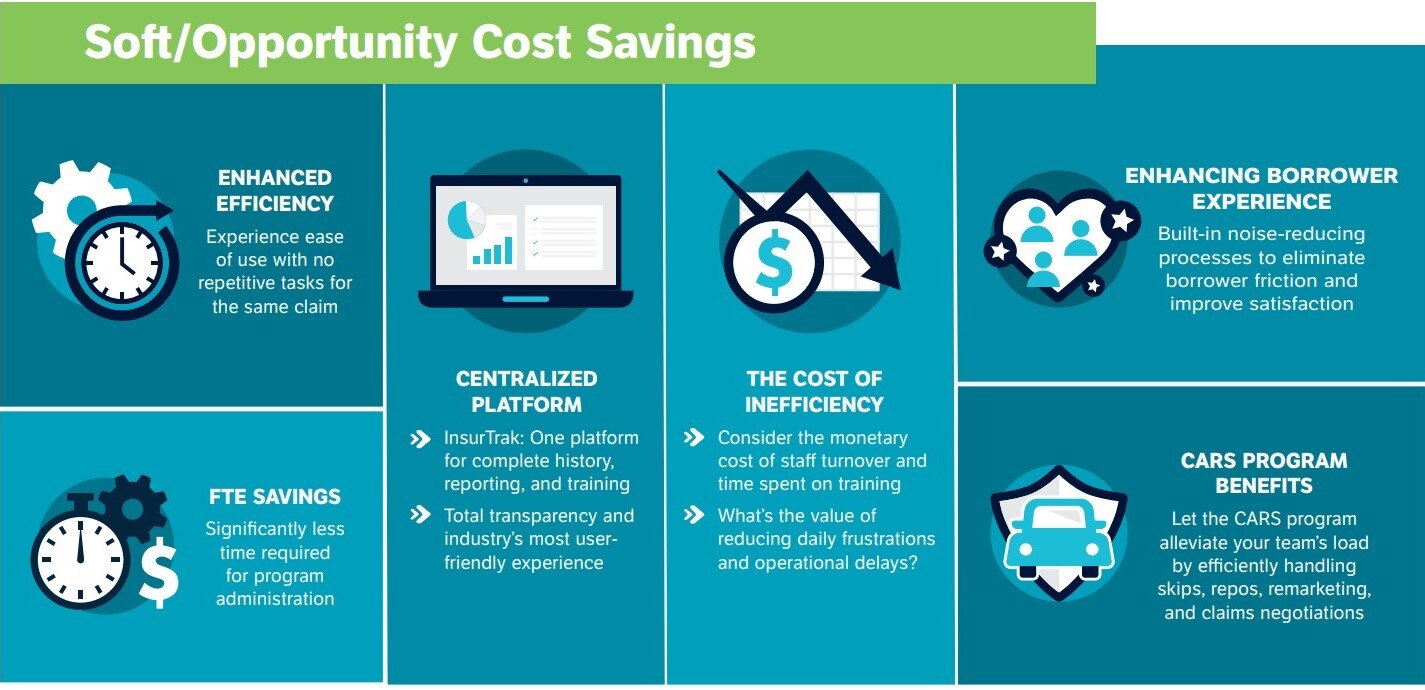

Soft Cost/Opportunity Cost Savings

- User-Friendly: Our programs reduce daily frustration and the need for multiple touches for the same claim.

- All-in-One Platform: InsurTrak offers complete history, reporting, and training, easily available on one easy-to-use platform.

- Turn-key Texting: We manage outbound texting, so your staff doesn’t have to — at no cost to you.

- Staff Efficiency: Consider the monetary cost of staff turnover, training, time value of labor, etc.

- Reduced Frustration: Can you put a dollar value on the frustrations, delays, follow-up emails, and non-returned calls experienced by your staff?

- Enhanced Borrower Experience: With instantly available recorded phone calls, our award-winning contact center, chat messaging & video chat, we significantly reduce borrower friction.

- Unmatched Customization: Because of our authority as both the carrier and the tracker, we have the ability to make more flexible decisions and offer custom program customization options to best meet your financial institution's needs.

- CARS Program: Takes the burden off your staff for recovering suspected skips, remarketing recovered collateral profitably at auction, and negotiating outside insurance claims.

When choosing a CPI program, dig deeper into the overall returns and support you receive. It's essential to consider both the tangible and intangible costs and benefits that contribute to overall effectiveness and impact on your bottom line.

From hard costs like actual claims dollars returned more quickly to soft costs such as ease of use and operational efficiencies, every factor plays a crucial role in determining the success and sustainability of your program.

The right program saves you money — but that’s not all. It also makes your operations smoother and more efficient. Consider the long-term returns, efficiency, and comprehensive support that can significantly impact your financial institution's portfolio protection program overall results.

Contact us today to discover the true value we can offer you!